At Zoho, we’re strong believers in India’s growth story. The recent events — Make in India, the move to digital payments, and the biggest of all tax reforms, GST — are setting up Indian businesses for growth and success.

Ever since the Rajya Sabha passed the GST bill in August 2016, we’ve been very busy. We set up a team of GST experts, who have analysed and understood the changes that businesses are going to experience in the new GST regime. When every invoice generated in the country has to pass through the GST Network (and that’s close to 260-300 crore invoices per month), you know that it’s not a simple transition but a mammoth task that the government has undertaken. Returns that until now could be filed once every 3 – 6 months, now have to be filed thrice a month.

In short, businesses can no longer leave their back office operations on the back burner. The finance department of every company has bigger priorities than spending hours on additional bookkeeping requirements. They will need robust technology that will help them transition to the new era with ease.

One nation, one tax, one software.

As GST unifies states and union territories with a single indirect tax, businesses can run their entire back office operations with a single vendor — Zoho. Zoho Finance apps are built from the ground up with the same database. This means that businesses using Zoho Finance Plus do not have to worry about duplicating data across apps or manually adding transactions. Transactions created in one app are made available contextually in the other apps.

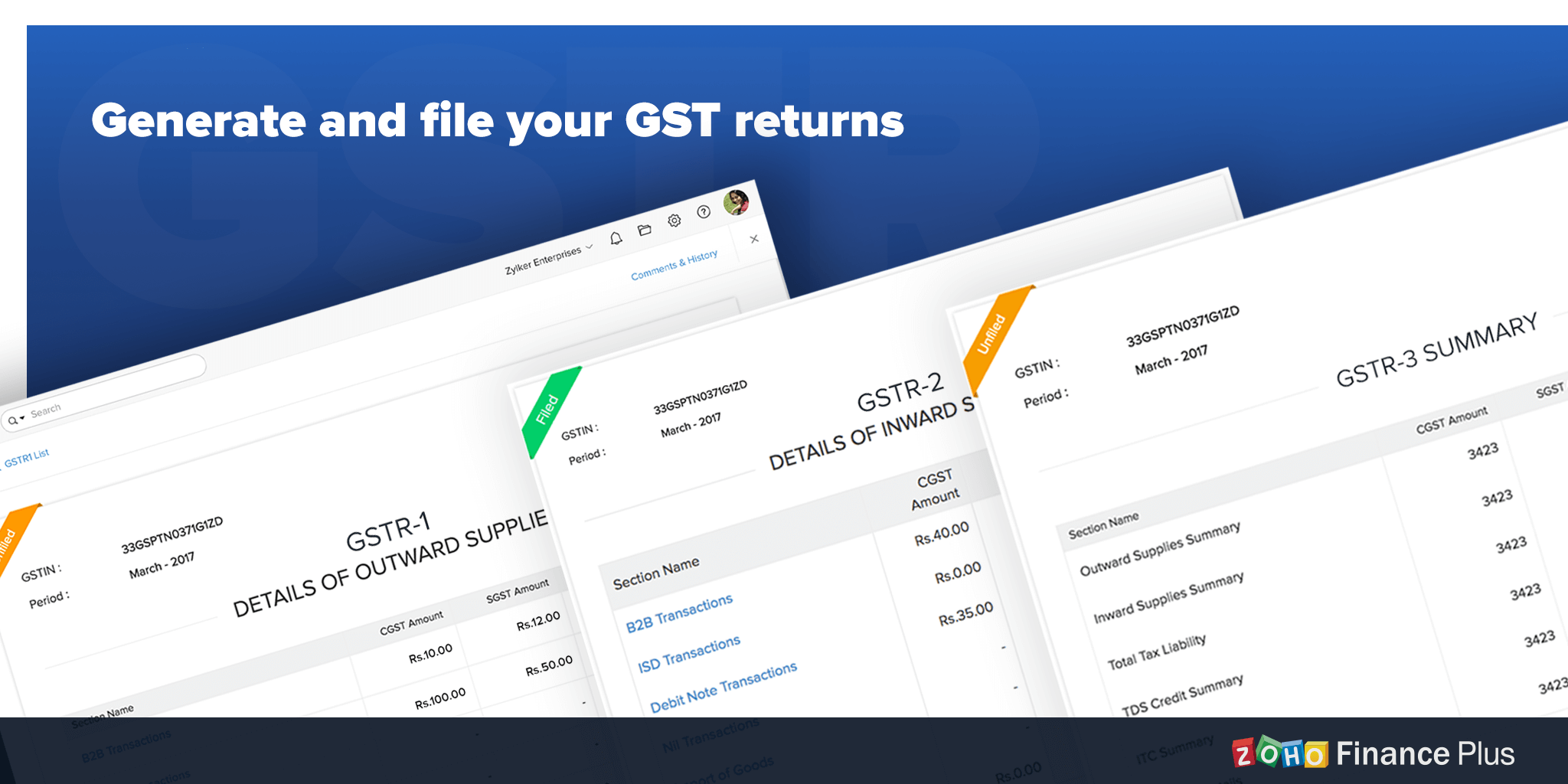

File GST returns with ease.

With Zoho Finance Plus, there’s no need to capture taxes separately or export data to another software for filing purposes. Businesses can create GST-compliant invoices and see the appropriate taxes captured on each transaction as it is generated. Zoho Finance Plus will generate all the monthly returns automatically so they can be filed with a click of a button.

Smart, beautiful software for India’s businesses.

For so long, Indian businesses were used to dull, dated, disconnected software. These products were functional, no doubt, but they never aimed at improving the user experience. With the changing landscape (including the upcoming GST and the rise of digital payments), businesses now have a reason to switch to software that’s online, connected, and able to make their work enjoyable. Simple things like fetching bank transactions online and reconciling them are a pleasure in Zoho Books — which makes the work feel a lot less like work.

How much does all this magic cost?

The entire Zoho Finance Plus suite is available for businesses at Rs2999/month/organization (excludes local tax). The Zoho Finance Plus suite includes:

-

Zoho Books: India’s most powerful and intuitive accounting software for forward-thinking businesses.

or, Zoho Invoice: Completely customizable invoicing software for freelancers or sole proprietors looking for a simple invoicing app to get paid on time.

-

Zoho Expense: Smart and engaging expense management app to keep track of employee expenses and reimbursements.

-

Zoho Subscriptions: Robust solution for subscription-based businesses to automate their recurring billing.

-

Zoho Inventory: Perfect order management and fulfillment solution for retailers in India.

All upgrades are part of the subscription fee.

Most businesses may have relied on spreadsheets and desktop accounting up until now, but that need not be the case anymore. Get GST-ready and choose software that evolves with your business needs.

Have questions about GST software or how to switch? Drop your comments below or write to us at support[at]zohofinanceplus[dot]com.